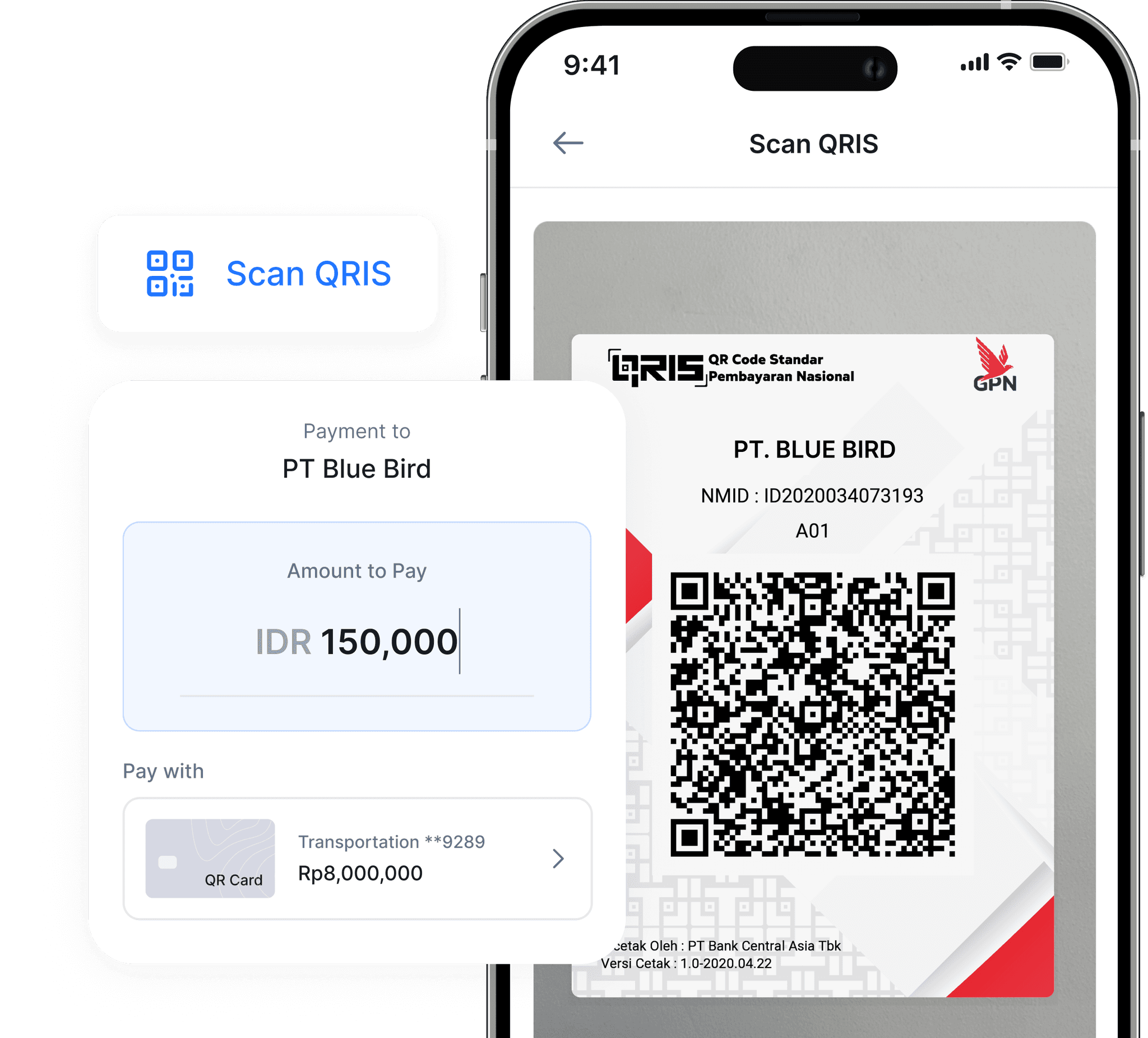

Business spend using QRIS

Implement a nationwide payment system using QRIS for your employees

What is QR Card?

When to use QR Card?

To gain complete control and visibility over your employee expenses, especially for sales personnel, create and assign QR Cards to specific merchants or employees to streamline budgeting. Monit enables you to generate multiple QR Cards with just a few clicks. Here are some situations where using a Monit QR Card is particularly beneficial:

→ When managing team budgets

Monit allows you to easily set and customize card limits, automatically declining any transaction that exceeds the limit to help manage your spending. You can also monitor spending activity conveniently through a dashboard on both your desktop and mobile phone.

→ When managing petty cash

Petty cash is often untraceable, making it unclear how your team spends it. With Monit QR card, you can provide your team with petty cash for offline transactions while maintaining control and visibility over their spending.

QRIS (Quick Response Code Indonesian Standard) payment for business purchases is a method where businesses use a standardized QR code to make payments to the vendors.

Business scan the QR code with their Monit app to complete the transaction. It simplifies payments, reduces the need for physical cash or cards, and speeds up the checkout process. It is a convenient and efficient way for businesses to handle transactions digitally.