Reimbursements

Reimbursements made simple with just a few clicks

Monit's expense reimbursement ensures that finance teams can confidently manage out-of-pocket expenses, with submissions, approvals, and processing tailored to their needs — all while staying within company policy

Say goodbye to reimbursement forms

Empower your employees

Let your employees reimburse themselves with Monit's easy-to-use mobile app, while you set an approval flow for each request

Make payment in a few clicks

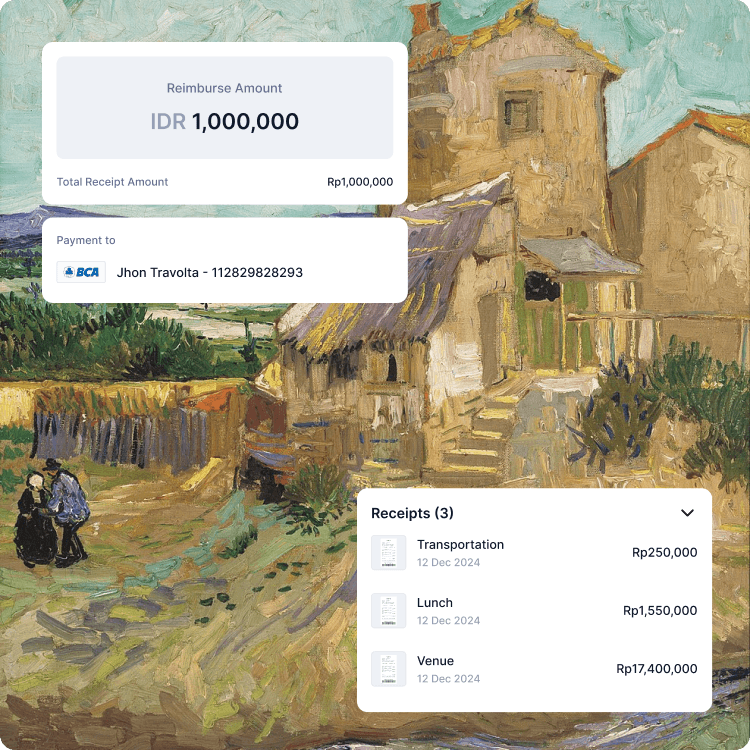

Quickly and transparently reimburse your employees. In just a few clicks, they’ll get their money back, regardless of how often they spend

Request for reimbursement

When an employee makes a purchase with their own money, they can quickly and easily log the expense in the Monit app.

When an employee makes a purchase with their own money, they can quickly and easily log the expense in the Monit app.

Approve reimbursement

Monit enables approval workflows, whether from team leads or finance, ensuring reimbursements receive the necessary sign-offs.

After a reimbursement is approved, the employee will receive a notification confirming the amount has been transferred to them—just ensure they’ve added their personal card or bank account details beforehand.

Monit enables approval workflows, whether from team leads or finance, ensuring reimbursements receive the necessary sign-offs.

After a reimbursement is approved, the employee will receive a notification confirming the amount has been transferred to them—just ensure they’ve added their personal card or bank account details beforehand.

Pay with options

You can send the reimbursement payment straight to their bank account. Minimal effort for you, fast repayment for them.

If you prefer, you can reimburse employees through their salary. Track this in Monit to stay on top of all reimbursements

You can send the reimbursement payment straight to their bank account. Minimal effort for you, fast repayment for them.

If you prefer, you can reimburse employees through their salary. Track this in Monit to stay on top of all reimbursements

Get started in just 5 minutes

Once you sign in to the platform, you can create cards in just a few clicks!

Get started in just 5 minutes

Once you sign in to the platform, you can create cards in just a few clicks!

Get started in just 5 minutes

Once you sign in to the platform, you can create cards in just a few clicks!

Get started in just 5 minutes

Once you sign in to the platform, you can create cards in just a few clicks!

Monit is a technology company, not a bank.

Debit account is provided by partner bank, Member LPS. Deposit insurance covers the failure of an insured bank.

The Monit Mastercard® Virtual and Physical Card are issued in Indonesia and by partner bank, Member LPS

Payment services are provided by multiple payment providers, licensed by Bank of Indonesia

To receive cashback, your card transactions must first be settled by the merchants. Please note that some merchants may take longer to settle.

Copyright © Monit. All rights reserved.

Monit is a technology company, not a bank.

Debit account is provided by partner bank, Member LPS. Deposit insurance covers the failure of an insured bank.

The Monit Mastercard® Virtual and Physical Card are issued in Indonesia and by partner bank, Member LPS

Payment services are provided by multiple payment providers, licensed by Bank of Indonesia

To receive cashback, your card transactions must first be settled by the merchants. Please note that some merchants may take longer to settle.

Copyright © Monit. All rights reserved.

Monit is a technology company, not a bank.

Debit account is provided by partner bank, Member LPS. Deposit insurance covers the failure of an insured bank.

The Monit Mastercard® Virtual and Physical Card are issued in Indonesia and by partner bank, Member LPS

Payment services are provided by multiple payment providers, licensed by Bank of Indonesia

To receive cashback, your card transactions must first be settled by the merchants. Please note that some merchants may take longer to settle.

Copyright © Monit. All rights reserved.