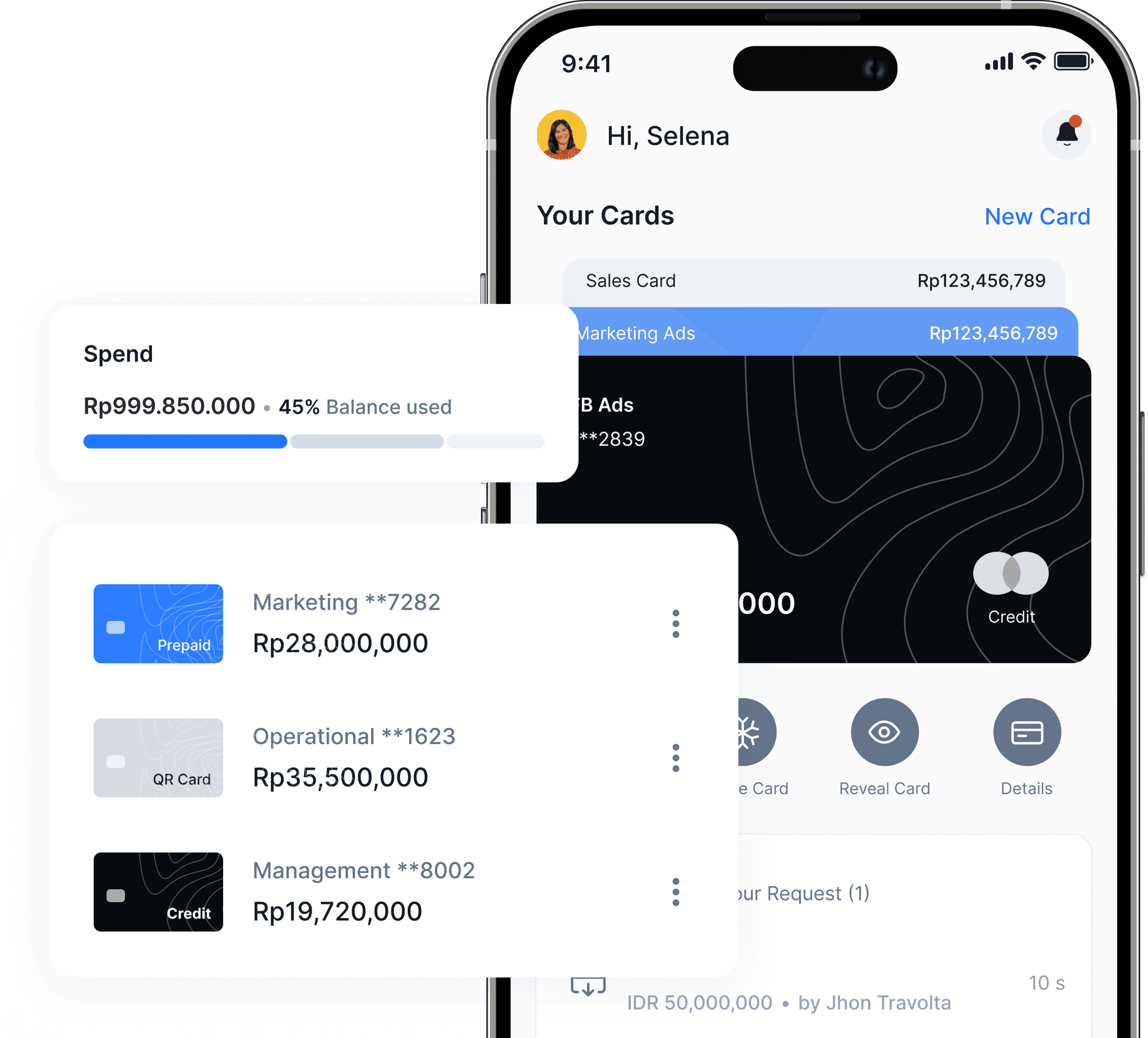

Empower your business with Monit virtual cards

Easily generate multiple virtual cards for business purchases, assign cards to specific users for budgeting, set controls, and more with just a few clicks.

What is Virtual Card?

When to use Virtual Card?

For complete control, visibility, and security, use a virtual card for every business payment. You can create a virtual card for specific merchants or employees to simplify budgeting. Monit allows you to generate multiple virtual cards with just a few clicks. Here are some situations where using a Monit virtual card is particularly helpful:

→ When managing team budgets

Monit allows you to easily set and customize card limits, automatically declining any transaction that exceeds the limit to help manage your spending. You can also monitor spending activity conveniently through a dashboard on both your desktop and mobile phone.

→ When storing card detail for subscriptions

Monit Cards lock to the first merchant they are used with and cannot be used elsewhere if stolen. In the event of a data breach, you can pause or close a Monit Card anytime, anywhere, without affecting your other cards.

→ When spend to ads

Virtual cards are commonly used for digital ads, such as Meta, Google, or TikTok

Monit virtual cards

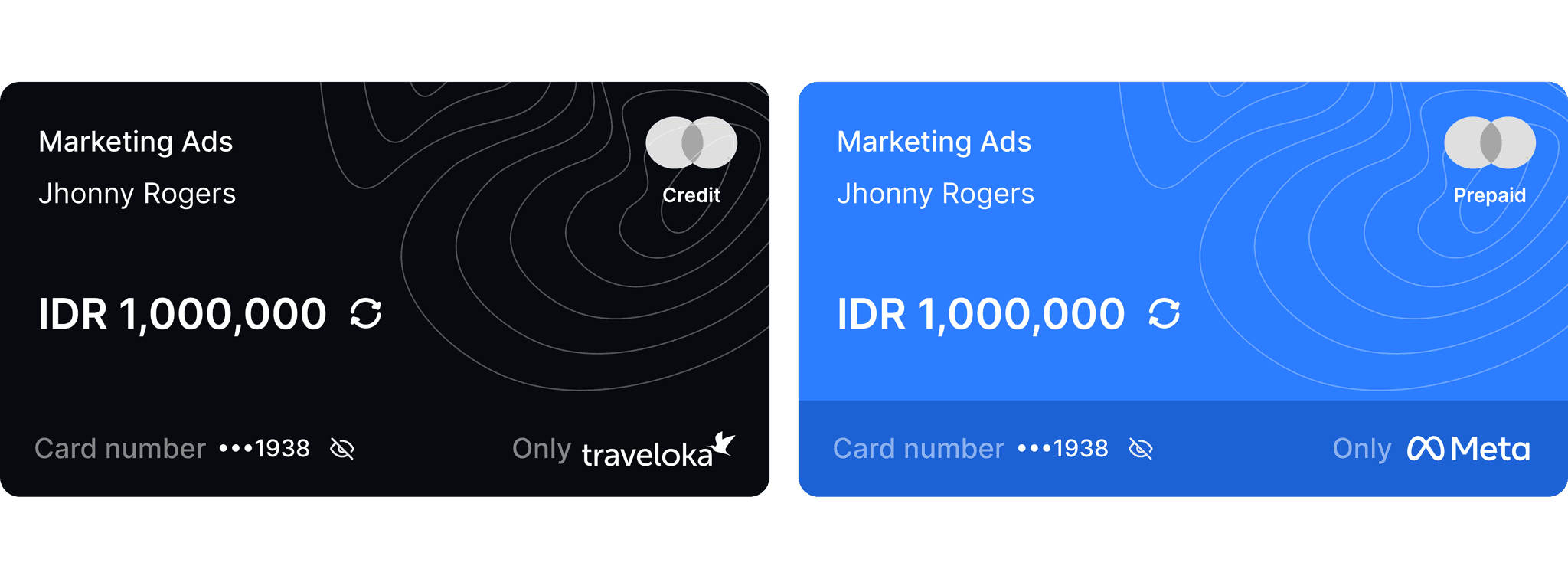

Monit provides 2 types of cards

Prepaid debit card

A prepaid card for business purchases is a payment card loaded with a specific amount of money that businesses can use to manage expenses.

Unlike credit or debit cards linked to a bank account, a prepaid card has a predetermined balance and does not involve borrowing or overdraft. It helps businesses control spending by setting limits and monitoring transactions, making it useful for budgeting and expense tracking.

Credit card

A credit card for business purchases is a payment card that allows businesses to buy goods and services on credit, up to a certain limit. The business can pay off the balance over time, typically with interest.

This type of card helps manage cash flow and track expenses. It is a convenient tool for making large purchases and managing short-term financial needs.